![4349 BAKELS Global And Local Bread Trends Image Social Posts [Option 1 Full Map] V2](https://bakels.b-cdn.net/wp-content/uploads/2023/07/4349-BAKELS-Global-and-Local-Bread-Trends-Image-Social-Posts-Option-1-Full-Map_V2-e1690302595630.jpg)

Bread sales across the world are growing, and more consumers say they have increased rather than decreased eating it in the past year. With the support of valuable Innova Insights, we discuss key global trends in bread and bread products to help you make informed choices for your local bakery business.

Bread has a higher than average global penetration than other categories, indicating that 81% have purchased in the past 12 months. Nearly all (94%) of these purchase fresh bread, with 29% buying preserved bread (refrigerated/frozen). Countries with the highest penetration include New Zealand (90%), South Africa (90%) and Chile (88%), with the lowest including Peru (64%), China (69%) and Thailand (69%).

There is a net positive difference (% increased minus % decreased) in bread users globally (+6pts), with particular increases in use coming among the top-10 most populous countries in the survey, India (+32pts), Philippines (+23pts), Malaysia (+17pts) and Peru (+14pts).

Why is there an increase in bread buying?

Top reasons for increasing consumption have been healthily (38%) and lifestyle/needs change (33%). With marked increase in variety and innovation in the market, consumers are also citing more variety and novelty available (29%) as a reason for increasing consumption, suggesting consumers are responsive to newness and innovation from producers.

As a staple and more affordable food item, over a third of consumers have increased their consumption because of budget changes, suggesting bread holds a resilient place in consumer shopping baskets.

What are consumers prioritising when buying bread?

Freshness (50%), flavour (48%) and cost (44%) are the top three attributes most influencing consumer fresh bread purchasing decisions globally. On a local level, health is a top influencing attribute in Nigeria, Egypt and Saudi Arabia, while shelf life features highly in Egypt, Brazil and China, all according to Innova’s Category Survey 2023.

As predicted, influencing factors differ between fresh and preserved bread purchases. Fresh bread purchases are driven above all by taste, while convenience is the number one reason for those purchasing preserved bread.

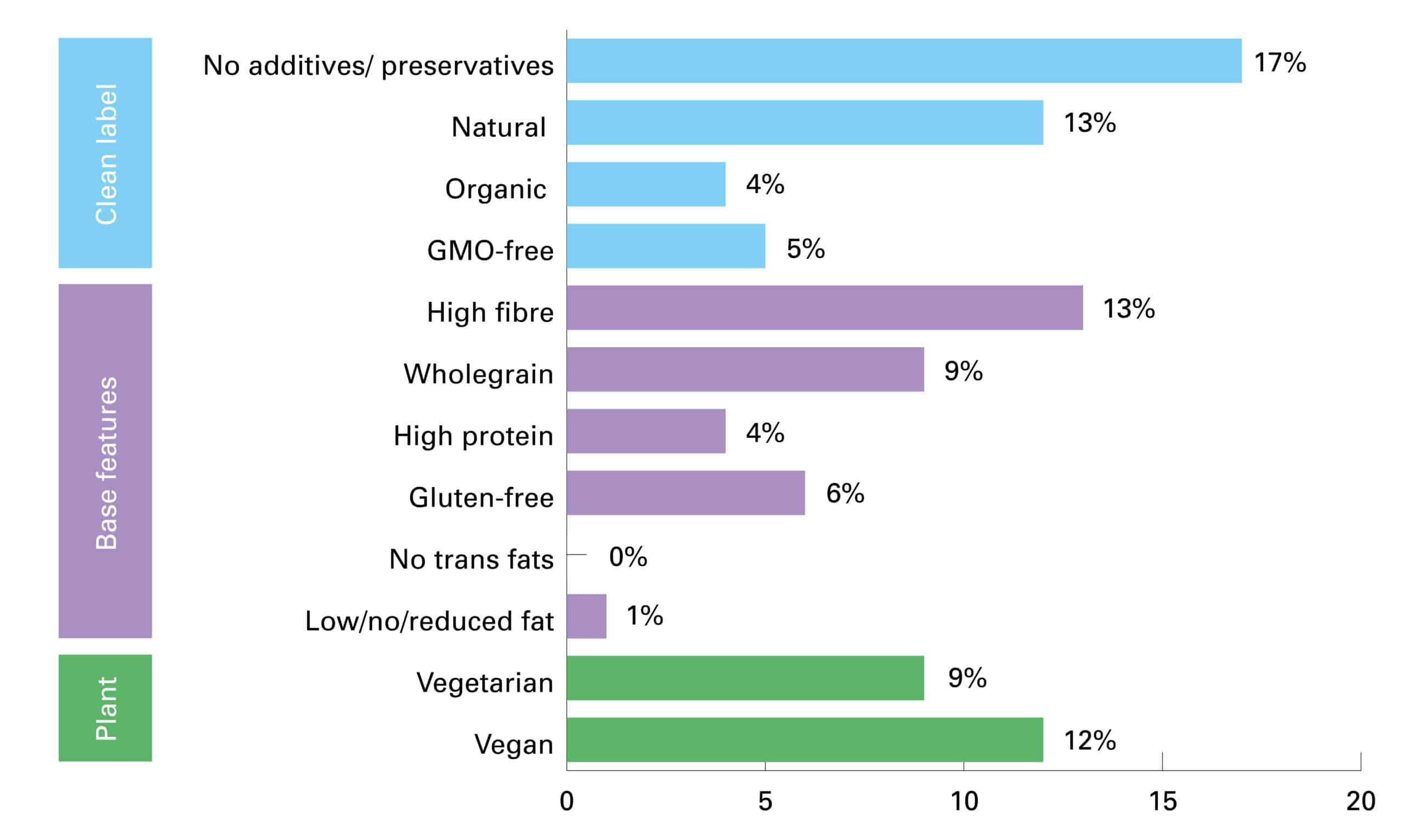

Global Bread: % of launches for top selected positionings

Click the region tabs below to reveal local positioning trends.

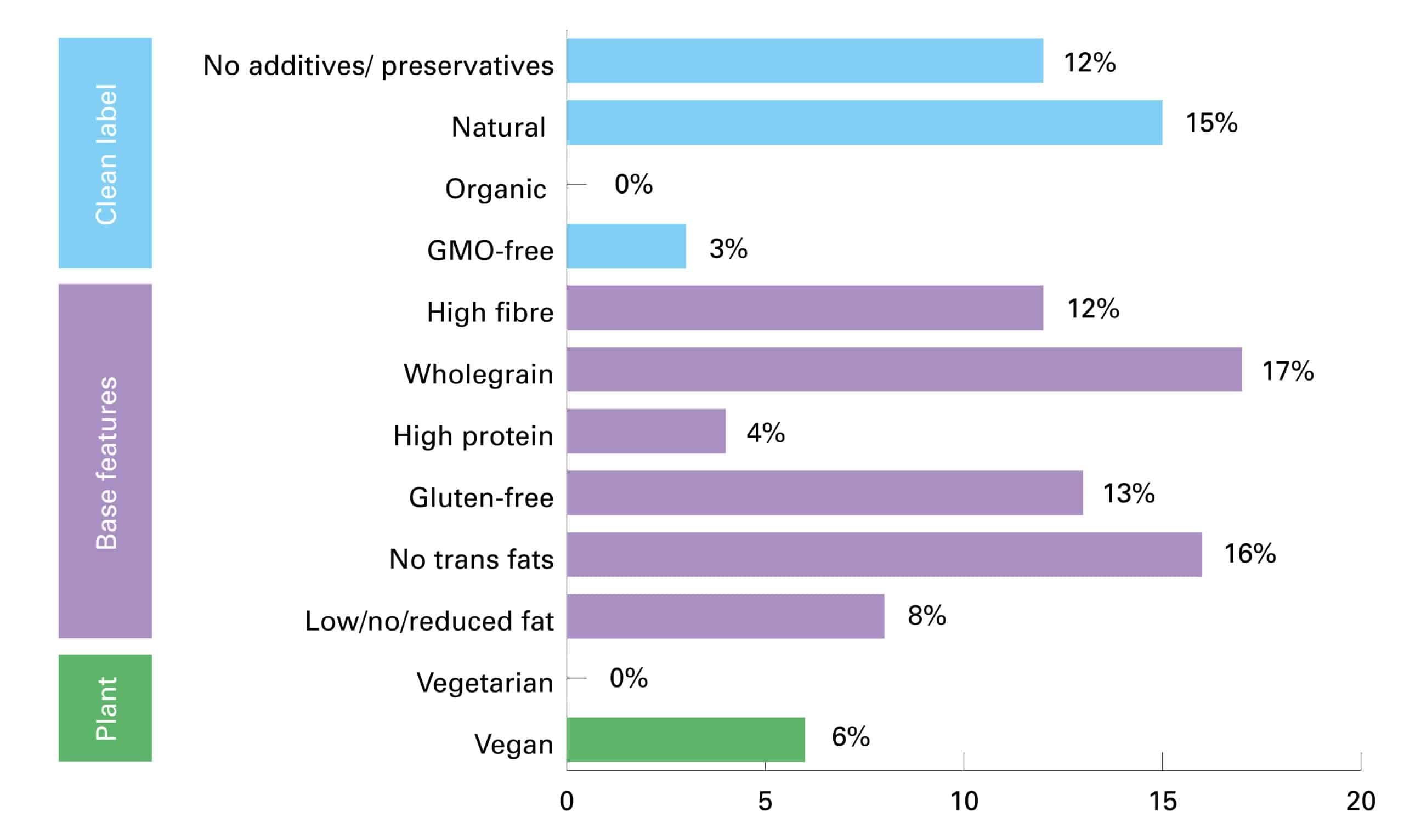

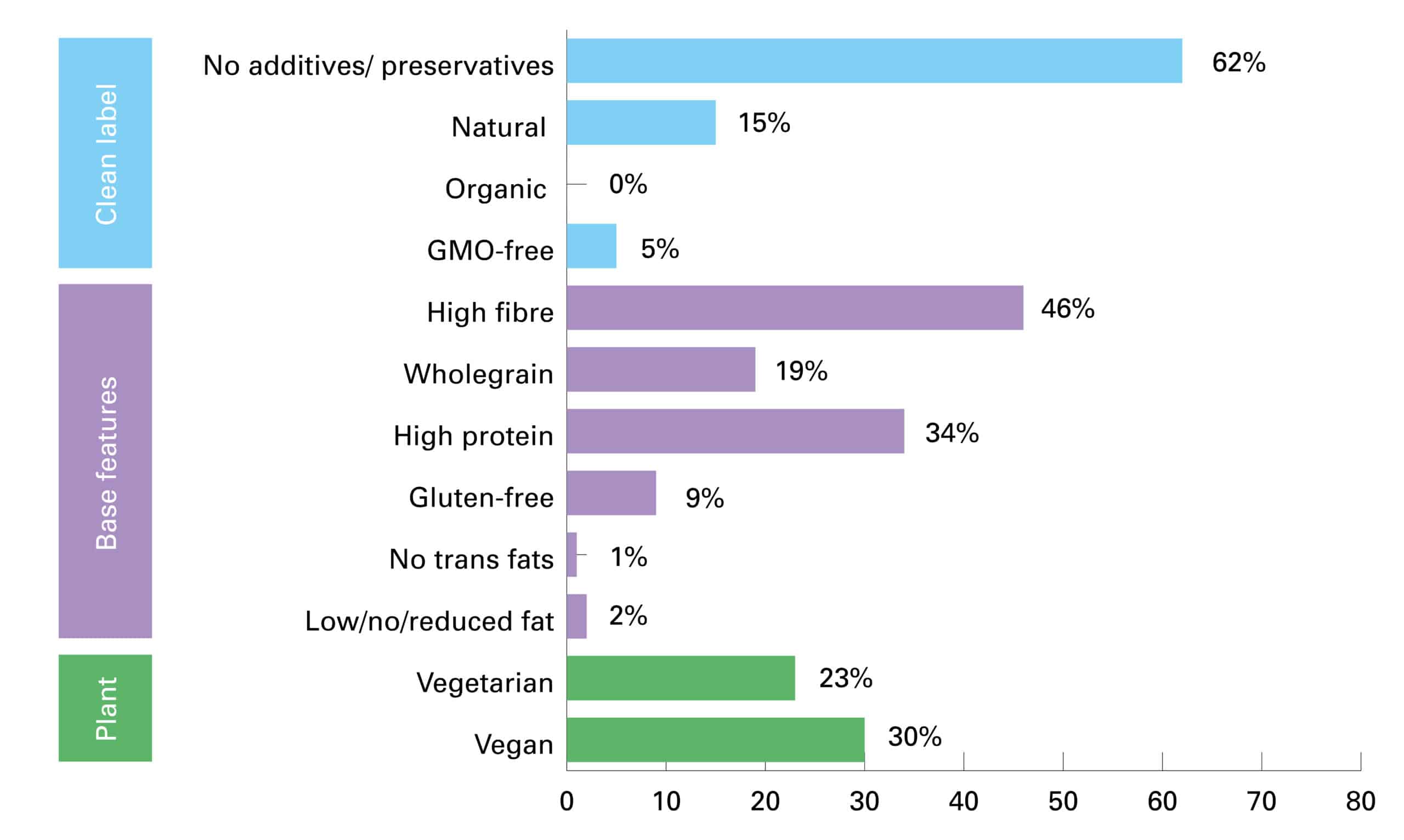

West Europe has a higher than average portion of bread launches citing natural, organic, high fibre, vegetarian and vegan claims.

East Europe use of natural, organic, high fibre, wholegrain, high protein, gluten-free, no trans fat and vegetarian claims is at or below the global average.

North America bread entries are notably more likely to include no additives, natural, no trans fat, GMO-free and low fat claims than globally.

Latin America has a higher than average portion of bread launches with wholegrain, gluten-free, no trans fat and low fat claims.

Africa has an above average use of high fibre, low fat, vegetarian and vegan claims on bread launches.

Asia bread entries are more likely to include vegetarian claims than globally.

Australasia has above average no additives or preservatives, high fibre, wholegrain, high protein, vegetarian and vegan claims on new bread entries.

Middle East bread entries are less likely to include most claims except no additives or wholegrain, which are similar to the global average.

Where are consumers most buying bread?

On a global level, it is supermarkets where consumers are most buying bread products (top markets: New Zealand [88%], Australia [85%] and Ireland [83%]), with specialty store (bakery) (top markets: Argentina [76%], Columbia [73%] and South Korea [71%]) and convenience stores (top markets: Thailand [79%], Indonesia [72%] and Malaysia [63%]) the next respective outlets of purchase.

While supermarkets have the benefit of attracting spend when consumers visit for their wider food shop, consumers globally view artisanal bakeries as better for price, quality and taste. This does vary locally however, with Latin American and Asian consumers preferring in-store bakeries across attributes.

Indulgence, flavours and fillings

Mainstream

Artisan, traditionally crafted breads including French loaves, ciabatta, focaccia, naan and other regional favourites are set to remain popular. Regional bread types may become more prevalent where they are less developed as the 45% of consumers who seek authenticity view them as affordable indulgences.

Emerging

Sourdough and brioche are likely to grow beyond current 4% and 3% of entries given notable recent growth, particularly in the Middle East and Africa and North and Latin America, respectively. More introductions are anticipated to cater to the 20% of consumers globally who prefer breads with strong or intense flavour.

Future

Cream or jam-infused breads may gain in popularity outside Asia, with options such as strawberry, raspberry, mango or premium honey. Extra soft versions of traditional favourites may reach retailer shelves to attract the 10% seeking indulgent textures.

Health halo

Mainstream

Breads made of whole wheat, rye, oat and other high-nutrition grains are likely to cite high fibre or high protein claims, given that about 20% of consumers globally show interest in these claims.

Emerging

More introductions are likely to include low sugar, sugar-free or no added sugar claims to cater to the 20% that seek products with these claims. More breads combining low carb, high protein and high fat will be launched to cater to consumers following keto diets. Interest in vegan, vegetarian and 100% plant-based positioning will continue with growth above the 10% of entries they currently represent.

Future

Vegetable ingredients such as pea, potato, chickpea, carrot or cauliflower may be used more frequently beyond wraps to signal healthier choices. Prebiotic in high fibre breads could see continued activity, given rising popularity of these claims.

Discover Bakels bread ingredients to serve your market

Data: Innova Category Insider: Global Trends in Bread & Bread Products – May 2023